About Our District

Departments

Event Tickets

BISD Bond

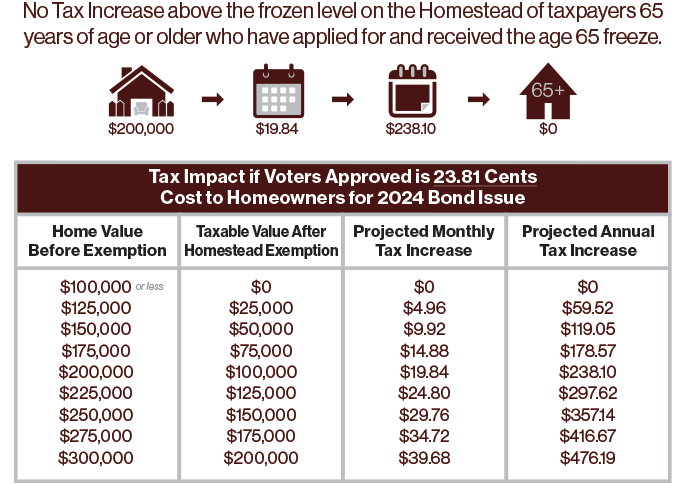

Under Texas state law, the dollar amount of school taxes imposed on a residence homestead of a person 65 years of age or older, cannot be increased above the amount paid in the first year after the person turned 65 or became disabled. The freeze applies regardless of changes in tax rate or property value, unless there are new improvements/additions to the homestead.

You must apply for this exemption with the County. See County links below in Calculator.